The German aerosol can market in 2024 is thriving, driven by robust demand in personal care, household, and pharmaceutical sectors, alongside a strong push for sustainable packaging solutions. Germany, a leader in Europe’s packaging industry, produced approximately 920 million aerosol units in 2023, with projections indicating a recovery in 2024 fueled by consumer demand for eco-friendly products (IGA, 2023). This article explores the market’s potential, the advantages of aluminum aerosol cans, and emerging trends shaping the industry, offering insights for B2B stakeholders seeking innovative packaging solutions.

Market Demand and Germany’s Competitive Edge

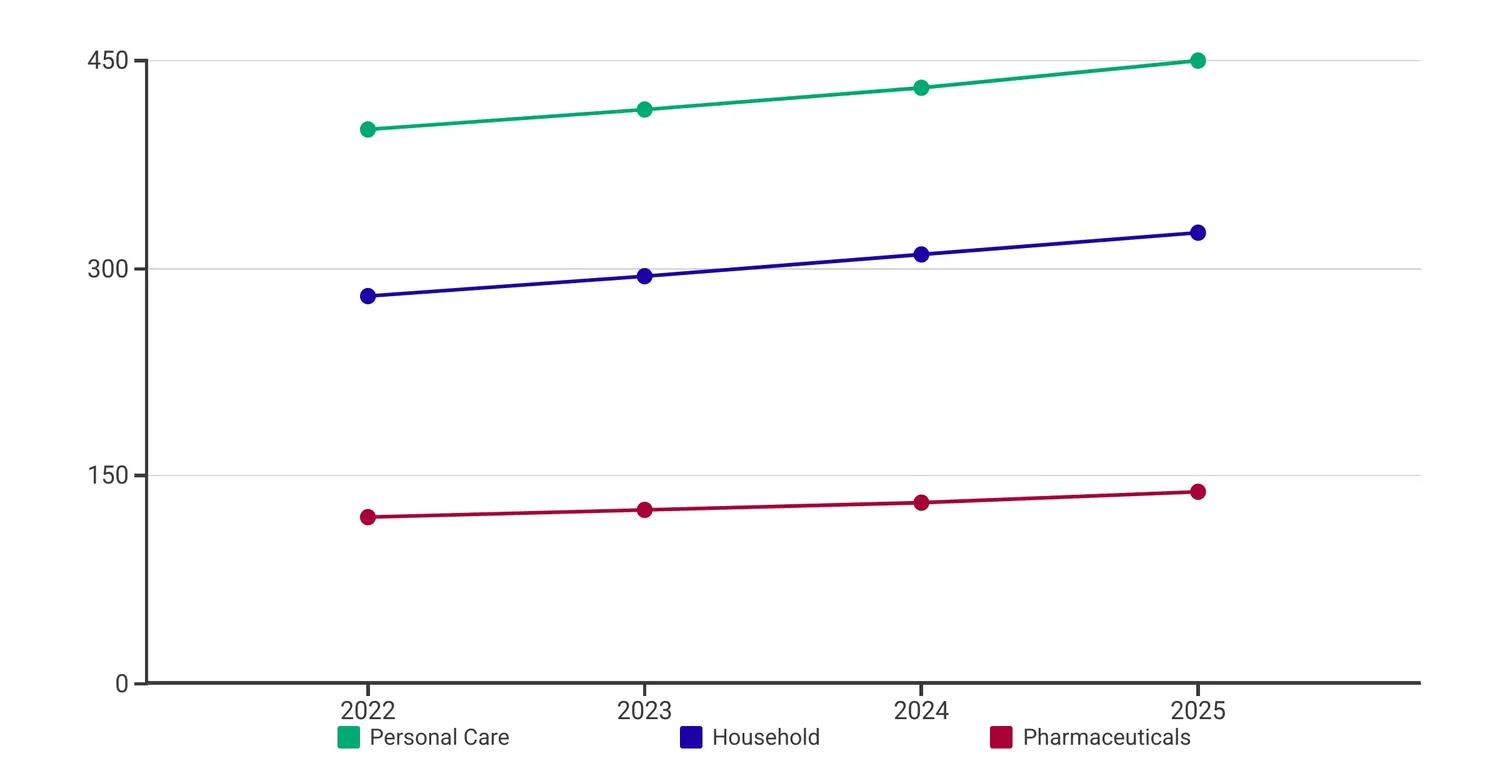

In 2024, the German aerosol can market continues to grow, supported by a 7.1% CAGR projected for the European aerosol market from 2024 to 2030 (Grand View Research, 2023). Key sectors driving demand include:

- Personal Care: Deodorants and hairsprays dominate, with a 3.2% increase in deodorant cans in 2023, reaching 415 million units (IGA, 2023). Urbanization and rising disposable incomes fuel this growth.

- Household Products: Air fresheners and cleaning agents saw a 5.1% production increase in 2023, driven by hygiene awareness (IGA, 2023).

- Pharmaceuticals: Metered-dose inhalers maintain steady demand, supported by Germany’s advanced healthcare infrastructure.

Germany’s leadership stems from its stringent environmental regulations, advanced manufacturing capabilities, and consumer preference for sustainable packaging. The country’s focus on circular economy principles aligns with the adoption of PCR aluminum (post-consumer recycled) and PIR aluminum (post-industrial recycled), making it a hub for eco-conscious packaging innovation. For instance, Beiersdorf reduced the carbon footprint of its deodorant cans by 58% in 2023 using recycled aluminum (Precedence Research, 2024).

Advantages of Aluminum Aerosol Cans

Aluminum aerosol cans are the preferred choice in Germany due to their unique properties, aligning with the market’s sustainability goals:

- High Recyclability: Aluminum can be recycled indefinitely without quality loss, with 85.6% of the global metal aerosol can market share in 2023 (Grand View Research, 2023). This supports Germany’s recycling targets under EU regulations.

- Lightweight Design: Aluminum cans are up to 30% lighter than traditional options, reducing transportation emissions (Mordor Intelligence, 2024).

- Aesthetic Appeal: Advanced printing techniques enable vibrant, customizable designs, enhancing brand visibility for personal care products.

- Corrosion Resistance: Aluminum’s durability ensures product integrity, ideal for sensitive formulations like pharmaceuticals.

These attributes make aluminum bottles and cans a cornerstone of Germany’s sustainable packaging landscape.

Emerging Industry Trends

The German aerosol can market is evolving rapidly, driven by technological advancements and shifting consumer preferences:

Innovations in manufacturing have led to lighter aluminum cans, such as Toyo Seikan’s 6.1g beverage can launched in 2024, reducing material use while maintaining strength (Future Market Insights, 2025).

The shift to compressed gas propellants like nitrogen and carbon dioxide minimizes environmental impact, aligning with Germany’s F-Gas regulations phasing out fluorinated gases by 2025 (FEA, 2023).

Aptar Beauty’s twist-to-lock valve actuators, introduced in 2023, enhance user experience and reduce waste, catering to premium personal care brands (Mordor Intelligence, 2024).

Personal care remains the largest segment, commanding 56% of the global aerosol can market in 2024, with deodorants and hairsprays leading due to convenience and branding opportunities (Mordor Intelligence, 2024). Household products grew by 5.1% in 2023, driven by hygiene trends, while industrial coatings saw a 10.6% increase due to automotive applications (IGA, 2023). Conversely, insecticides declined by 33.3% in 2023, reflecting regulatory restrictions on chemical use.

Aluminum vs. Tinplate Cans: A 2023-2024 Comparison

The choice between aluminum aerosol cans and tinplate cans depends on application and sustainability goals. Below is a comparison based on 2023 data and 2024 trends:

| Material | Production (2023, Million Units) | Main Applications | Advantages | 2024 Trend |

|---|---|---|---|---|

| Aluminum | 512 | Personal Care (Deodorants, Hairsprays) | Lightweight, recyclable, aesthetic | Increasing share due to sustainability |

| Tinplate | 408 | Industrial, Household (Paints, Cleaners) | Durable, cost-effective | Stable, but losing share to aluminum |

Source: IGA, 2023; Canmaking News, 2024

In 2023, aluminum cans accounted for 55.6% of Germany’s aerosol production, with a projected increase in 2024 due to consumer preference for sustainable packaging (Canmaking News, 2024). Tinplate remains relevant for industrial applications but faces challenges due to its heavier weight and lower recyclability.

Shining’s Commitment to Excellence

At Shining, we pride ourselves on delivering high-quality aluminum aerosol cans that meet international standards, including ASI certification for sustainable aluminum sourcing. With extensive export experience, we offer customizable, eco-friendly solutions compliant with German and EU regulations. Our advanced production ensures precision and reliability, making us a trusted partner for global brands. We look forward to collaborating with businesses seeking innovative, sustainable aluminum aerosol can solutions.

Conclusion & Call to Collaborate

The 2024 German aerosol can market presents significant opportunities for businesses embracing sustainability and innovation. With strong demand in personal care and household sectors, aluminum aerosol cans lead the way due to their recyclability, lightweight design, and aesthetic appeal. Trends like eco-friendly propellants and smart valves further enhance market potential. By partnering with reliable manufacturers, brands can capitalize on Germany’s commitment to sustainable packaging and drive growth in this dynamic industry.

References

- Grand View Research. (2023). Europe Aerosol Market Report.

- Mordor Intelligence. (2024). Aerosol Cans Market Analysis.

- Precedence Research. (2024). Aerosol Cans Market Report.

- Canmaking News. (2024). Aluminum Aerosol Can Deliveries in Germany.

- Future Market Insights. (2025). Aluminum Cans Market Insights.