The Franch aerosol can market in 2024 has shown remarkable resilience and growth, with total filling volumes reaching approximately 1.45 billion units, a 2% increase from 2023’s 1.42 billion units. This resurgence marks a pivotal moment for the industry, driven by a shift towards aluminium aerosol cans, which now command a 68% market share, up from 62% in 2023. The rise of aluminium is fuelled by its sustainability credentials, lightweight design, and aesthetic versatility, aligning with consumer demand for eco-friendly packaging and stringent regulatory requirements.

Key demand areas include personal care, which accounts for 72% of total production (518 million units), with deodorants (+3%) and haircare products (+13%) showing notable growth. The “other” category, encompassing food and industrial applications, surged by 36%, reflecting France’s adaptability to emerging consumer needs, such as edible oil sprays (+61%). These trends highlight France’s ability to meet diverse market demands while prioritizing environmental responsibility, positioning it as a leader in the European aerosol landscape.

Why Aluminum Aerosol Cans Dominate in France

Aluminum aerosol cans continue to lead the French market, commanding 61.5% of production in 2024. Their dominance is driven by several advantages that align with France’s environmental and consumer preferences:

- Infinite Recyclability: Aluminum can be recycled indefinitely without quality loss, supporting France’s circular economy goals.

- Lightweight Design: Aluminum’s lightweight nature reduces transportation emissions, enhancing sustainability.

- Superior Printability: High-quality printing on aluminum enhances brand appeal, crucial for personal care and premium products.

- Corrosion Resistance: Ideal for sensitive formulations like pharmaceuticals and cosmetics.

The adoption of Post-Consumer Recycled (PCR) and Post-Industrial Recycled (PIR) aluminum is gaining traction. For instance, Beiersdorf’s NIVEA introduced aerosol cans with 50% recycled aluminum in 2023, setting a benchmark for sustainable packaging in Europe. Such initiatives resonate with French consumers, who increasingly prioritize eco-friendly products, further solidifying aluminum’s market position.

Industry Trends Shaping the Aluminum Aerosol Can Market

Innovations in Design and Technology

The France aerosol can market is evolving through technological advancements that enhance functionality and sustainability. Key trends include:

- Lightweight Cans: Manufacturers are reducing aluminum usage through thinner can walls, lowering material costs and carbon footprints.

- Eco-Friendly Propellants: Low-VOC propellants, such as dimethyl ether and compressed gases like nitrogen, are replacing traditional high-impact options, aligning with EU environmental standards.

- Smart Valve Systems: Precision valves improve product dispensing, particularly for pharmaceuticals and personal care, enhancing user experience.

These innovations reflect France’s commitment to meeting global standards, such as those set by the Aluminium Stewardship Initiative (ASI), ensuring responsible sourcing and production.

Category Shifts and Drivers

The 2024 market saw significant category shifts. Personal care remained dominant, with haircare (+13%) and sun protection products (+10%) thriving due to new brand launches and consumer trends favoring convenience. The “other” category’s 36% growth was driven by food applications (+61%) and industrial products (+42%), reflecting production repatriation and innovative applications like edible oil sprays. Conversely, household products declined by 5%, with carpet and textile care plummeting 88%, possibly due to alternative packaging formats and post-pandemic inventory adjustments. These shifts underscore France’s dynamic market, adapting to consumer preferences and global supply chain changes.

Aluminum vs. Tinplate: A Data Comparison

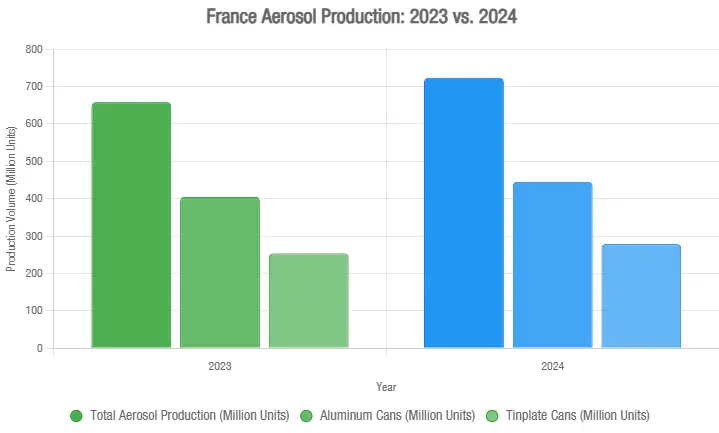

The following table compares aluminum aerosol can and tinplate can production in France for 2023 and 2024:

| Year | Total Production (Million Units) | Aluminum Cans (Million Units) | Aluminum Share (%) | Tinplate Cans (Million Units) | Tinplate Share (%) |

|---|---|---|---|---|---|

| 2023 | 657.91 | 404.50 | 61.5% | 253.41 | 38.5% |

| 2024 | 723.00 | 444.98 | 61.5% | 278.27 | 38.5% |

Data Source: EUWID Packaging, 2024. Aluminum’s consistent share reflects its sustainability advantages, while tinplate remains relevant for cost-sensitive applications. The stable ratio suggests a mature market balancing performance and cost.

Shining: A Trusted Partner in Sustainable Packaging

Shining, a leading aluminum aerosol can manufacturer, exemplifies quality and innovation in world’s aerosol industry. With a focus on high-precision production, Shining delivers customizable, ASI-compliant cans that meet international standards. Its extensive export experience ensures reliable solutions for global brands, emphasizing eco-friendly designs like PCR aluminum cans. Shining looks forward to collaborating with partners worldwide to provide cutting-edge sustainable packaging solutions that align with France’s environmental goals.

Looking Ahead: The Future of France Aerosol Cans

The France aerosol can market is poised for continued growth, with a projected CAGR of 8.1% through 2030, driven by sustainability and innovation. Aluminum aerosol cans will remain central, supported by advancements in lightweight designs and eco-friendly propellants. As consumer demand for convenient, eco-conscious packaging grows, France’s leadership in the European aerosol sector is assured, offering opportunities for brands to leverage its expertise and infrastructure.